The Ripple Effect: The Final Chapter.

Explore the unintended consequences of the Cobra Effect, revealing how well-meaning policies can create ripple effects that destabilize entire industries.

In this AUDIO course you will learn how this relatively new and more visually-based business...

In the fall of 2016, I had an opportunity to spend 2 nights with a...

Explore the unintended consequences of the Cobra Effect, revealing how well-meaning policies can create ripple effects that destabilize entire industries.

Explore the layered impact of tariffs on small businesses, from immediate price changes to long-term effects on market competition and domestic production stability.

Explore the unintended consequences of the Child Tax Credit, including how increased financial relief for families may lead to higher child care costs and limit the policy’s effectiveness.

Learn how a proposed $50,000 tax credit for startup expenses could encourage overspending, create cashflow risks, and lead to long-term debt obligations for small business owners.

Explore the nuanced impacts of anti-price gouging policies on small businesses in this episode of The Ripple Effect, where we dissect the layered consequences of dynamic pricing regulations during crises.

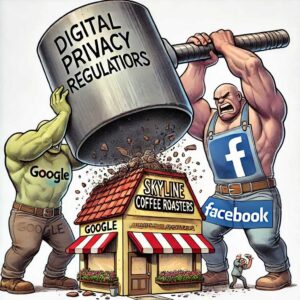

Explore the ripple effects of Digital Privacy Regulations on small businesses, including compliance costs, the end of cookies, and the growing dominance of big tech in digital advertising.

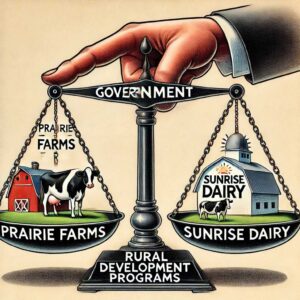

Explore the ripple effects of rural development programs and subsidies, examining how government intervention distorts market dynamics and impacts small businesses in both the short and long term.

Explore the nuanced effects of raising taxes on the rich, including its impact on small business owners and the broader economy, while challenging common perceptions about wealth distribution and tax fairness.

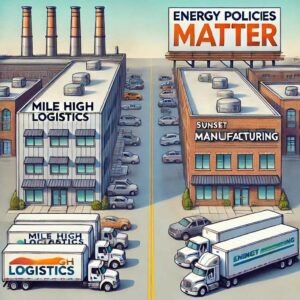

Explore the ripple effects of energy policy on small businesses, from rising costs and environmental impacts to global consequences and economic challenges. Understand how government choices influence both local operations and worldwide sustainability.

Explore the first, second, and third-order effects of federal contracting opportunities on small businesses, including immediate growth, compliance challenges, and long-term financial risks.

While Tax Incentives Offer Immediate Benefits, They Can Also Lead to Unintended Economic Distortions. Their Broader Impacts Should Be Carefully Considered, Suggesting a Judicious Use of Such Policies.

Explore the Nuanced Impacts of Net Neutrality on Small Businesses, Examining Its Immediate Benefits and Potential Challenges in Fostering a Competitive and Innovative Market Environment.

2021 © SteveBizAcademy – Online Business Courses